Accessing voluntary carbon markets

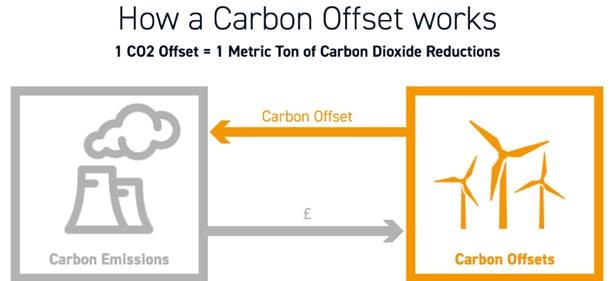

The global market for carbon credits, also known as carbon offsets, is gaining momentum as companies voluntarily target stricter climate goals and recognise the role and value of carbon credits within a comprehensive climate strategy. The topic is increasingly important in climate engagement, and management teams are expected to outline the scale, scope and strategy of their goals and the use of tools such as carbon credits. Accessing the market for voluntary carbon credits requires careful consideration for corporate buyers. Foremost ensuring that that credits have integrity and are of a high quality. The market remains heavily fragmented with a wide range of prices affected by idiosyncratic factors such as the specific registry’s standards, the vintage and the size of the transaction itself, the geography and the category of the projects, as well as the additionality of co-benefits. Most credits are traded over the counter (OTC), resulting in limited liquidity and price transparency.

There is a need for improved pricing data and qualitative research and analytical tools to ascertain a fair value for the many different types of projects on offer – an assessment that brings price transparency without stripping the individuality of projects. There are several initiatives underway the Taskforce on Scaling Voluntary Carbon Markets (TSVCM) is looking at how the market can be improved and expanded in order to achieve the greater scale required. There is also the Integrity Council for the Voluntary Carbon Market (ICVCM) an independent governance body for the voluntary carbon market, to ensure the market accelerates and builds trust. These initiatives and recent surge in interest have prompted greater efforts to accelerate adoption, with strong governance and infrastructure to support the rapid growth of VCM.

Recently, tightening supply has driven up prices for many types of credits. With increased corporate commitments to Net Zero we expect retirements to increase and good quality supply to remain constrained resulting in the ratio of surplus to annual retirements to decrease over coming years. Near-term supply will come from nature-based solutions (NBSs), comprising forest restoration and avoided deforestation, while medium- and long-term supply will be needed from negative emissions technologies (including carbon capture & storage (CCS), and bioenergy with CCS), and greater renewable energy in least developed countries. One should follow the recommended mitigation hierarchy of avoid, reduce and offset but companies can introduce offsets immediately as part of an ongoing pathway to decarbonisation.

Carbon offsetting is not a solution to climate change – there is no single path to Net Zero and the journey will be different across industries. That said, most companies could accelerate their pathway by utilising high-quality offsets. The market value of voluntary carbon credits doubled to over $1bn. It is estimated that the market will have to expand substantially – 15-fold by 2030 and 100-fold by 2050 to meet forecast demand. Offsetting is a strategic tool for companies committed to a long-term decarbonisation strategy but comes with careful consideration.

For more information, please contact:

Hari Sandhu: +44 207 601 6135 / [email protected]

For media enquiries, please contact:

Adele Gilbert: +44 (0)7484 778 331

Note to editor

About Shore Capital

We are an independent securities business offering institutional and corporate clients leading investment banking, research, sales and trading services, including fixed income. We are represented across the UK enabling extensive distribution and institutional coverage. This distribution capability is complemented by our experienced corporate advisory and broking team who offer discreet, innovative and valued advice to companies on both the Main Market and AIM. Shore Capital is also the 3rd largest market maker by number of AIM stocks covered.

Our cross-disciplinary team has deep, market leading experience in a wide range of small and mid-cap UK companies within the following sectors: Consumer, Financials, Healthcare, Insurance, Natural Resources, Real Estate, Support Services, Technology and Media. Our research on over 250 companies is distributed to an extensive institutional client base in the UK, Europe and US.

Shore Capital is a trading name of both Shore Capital Stockbrokers Limited and Shore Capital and Corporate Limited.