A guide to the UK Streamlined Energy and Carbon Reporting (SECR) scheme

Ling Sin Fai Lam, Director, ESG & Sustainability

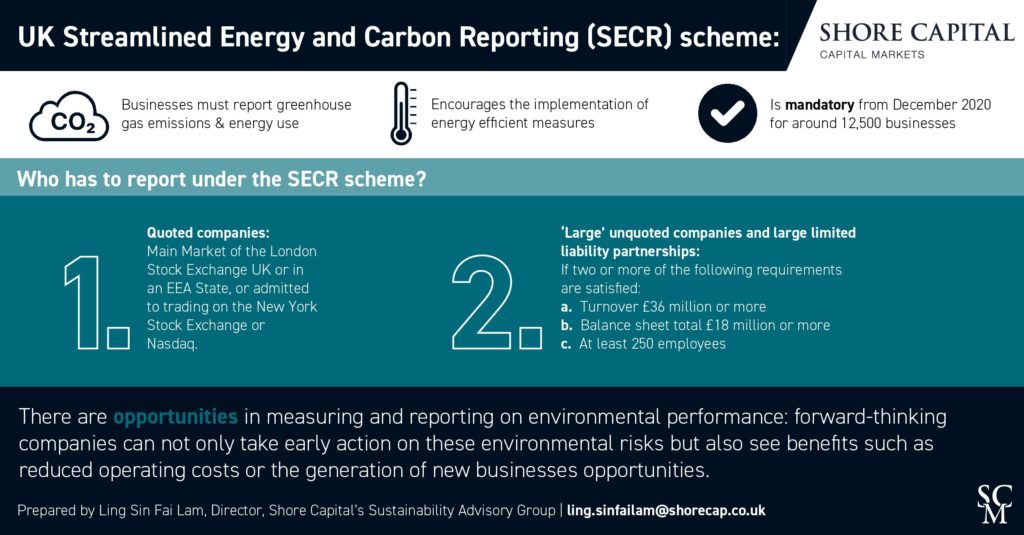

The Streamlined Energy and Carbon Reporting (SECR) scheme is mandatory for British businesses to report their greenhouse gas emissions and energy use (from electricity, gas and transport). The reporting scheme aims to encourage the implementation of energy efficiency measures, which has both economic and environmental benefits, and support companies in cutting costs and improving productivity at the same time as reducing carbon emissions.

The overall UK market size for mandatory SECR reporting requirements is around 12,500 businesses and it superseded the Carbon Reduction Commitment (CRC) Energy Efficiency Scheme, which impacted just 4,000 businesses. For companies within scope with a December year end, the first financial year for which the SECR becomes mandatory is December 2020.

Climate change continues to move up the investor agenda and we can see in our work the number of investors that are implementing comprehensive action plans are increasing by the day. Indeed, from October 2021, larger UK pension schemes will be required to make disclosures in line with the recommendations from the Task Force on Climate-Related Financial Disclosure (TCFD). TCFD-aligned disclosures are also expected to become mandatory across non-financial sectors of the UK economy by 2025.

Under scrutiny from investors and other stakeholders to become more accountable for their emissions, it is reasonable to expect companies in turn to put pressure on businesses within their supply chain to comply with better environmental standards; organisations that do not measure and report on their environmental performance could risk losing out to competitors that are able to demonstrate understanding and leadership.

The SECR reporting landscape could well see further developments in scope and ambition in the future, but by measuring and reporting on environmental performance, forward-thinking companies can not only take early action on these environmental risks but also see benefits such as reduced operating costs or the generation of new businesses opportunities.

Companies fall into three camps:

- Quoted companies: Main Market of the London Stock Exchange UK or in an EEA State, or admitted to trading on the New York Stock Exchange or Nasdaq.

- ‘Large’ unquoted companies and large limited liability partnerships: If two or more of the following requirements are satisfied:

- Turnover £36 million or more.

- Balance sheet total £18 million or more.

- At least 250 employees.

- All other companies (nothing needs to be done).

For (1) and (2), SECR reporting is MANDATORY!

For (1); Quoted companies

SECR requirements are as follows:

Quoted companies within the scope of the legislation must continue as a minimum to disclose in their Directors’ Report:

- Annual greenhouse gas (GHG) emissions from activities for which the company is responsible including combustion of fuel and operation of any facility, and the annual emissions from the purchase of electricity, heat, steam or cooling by the company for its own use

- Underlying global energy use

- Previous year’s figures for energy use and GHG

- At least one intensity ratio

- Energy efficiency action taken

- Methodology used

For financial years starting on or after 1st April 2019, quoted companies also need to state what proportion of their energy consumption and their emissions is in the UK (including offshore area).

For (2); ‘Large’ unquoted companies and large limited liability partnerships

SECR requirements are as follows:

Unquoted companies and Limited Liability Partnerships in scope of the legislation will be required to disclose energy and carbon information in their accounts and reports, including:

- UK energy use (to include as a minimum purchased electricity, gas, and transport)

- Associated greenhouse gas emissions

- At least one intensity ratio

- Previous year’s figures for energy use and GHG emissions (except in the first year)

- Energy efficiency action taken

- Methodology used

Additionally, if you are an offshore undertaking (i.e., if your activities consist wholly or mainly of offshore activities as defined in the 2018 Regulations) you must disclose your emissions and energy use for the UK and the offshore area.

Source: HM Government Environmental Reporting Guidelines: Including streamlined energy and carbon reporting guidance. March 2019 (Updated Introduction and Chapters 1 and 2)